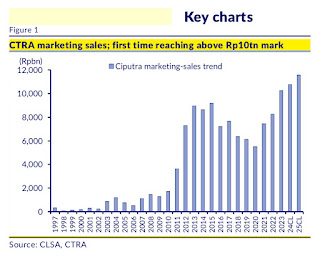

CTRA marketing sales; first time reaching above Rp10tn mark.

Solid Presales Beat, +24% YoY Growth

CTRA’s FY23 presales was a strong beat, 5% above guidance and +24% yoy. Launches made up some Rp 4.9tn, +101% yoy, while Rp 769bn came from the VAT incentive sales (-42% yoy). Greater Jakarta and greater Surabaya contributed 71% to total FY23 presales. CTRA also has additional Rp 844bn in from a new Medan project to be recognized in FY24.

FY23: Rp 10.2tn presales, +24% yoy, 5% above guidance. CTRA’s beat was helped significantly by new project launches, which contributed Rp 4.9tn throughout the year. Presales contribution from new launches grew +101% yoy, helped by 3 new project launches – Citra Garden Serpong, Citra City Sentul and Citra Garden Bintaro. The VAT incentive, which was re-instated in a different format starting Nov-23, contributed Rp 769bn, albeit including an overlap of Rp 400bn from the newly-launched Citra Garden Bintaro which also qualify for the incentive. In contrast, in FY22, VAT incentive sales contributed Rp 1.3tn.

4Q23: Rp 2.4tn presales, -10% qoq/+45% yoy. 4Q23 saw the launches of 2 new projects, Citra City Sentul, and Citra Garden Bintaro. The existing launches from the 2 projects generated 67%/63% take-up respectively, with aggregate contribution of Rp 1.4tn. There was an additional launch in Surabaya adding Rp 136bn. 4Q23 also saw VAT incentive presales adding Rp 769bn, as mentioned above.

CitraLand KDM Sampali launched, Rp 844bn proceeds raised. Offering took place in Dec- 24 but the proceeds will be recognized in FY24’s presales. The project has offered residential units priced Rp 1.8-4.7bn and shop houses between Rp 2.5-2.7bn.